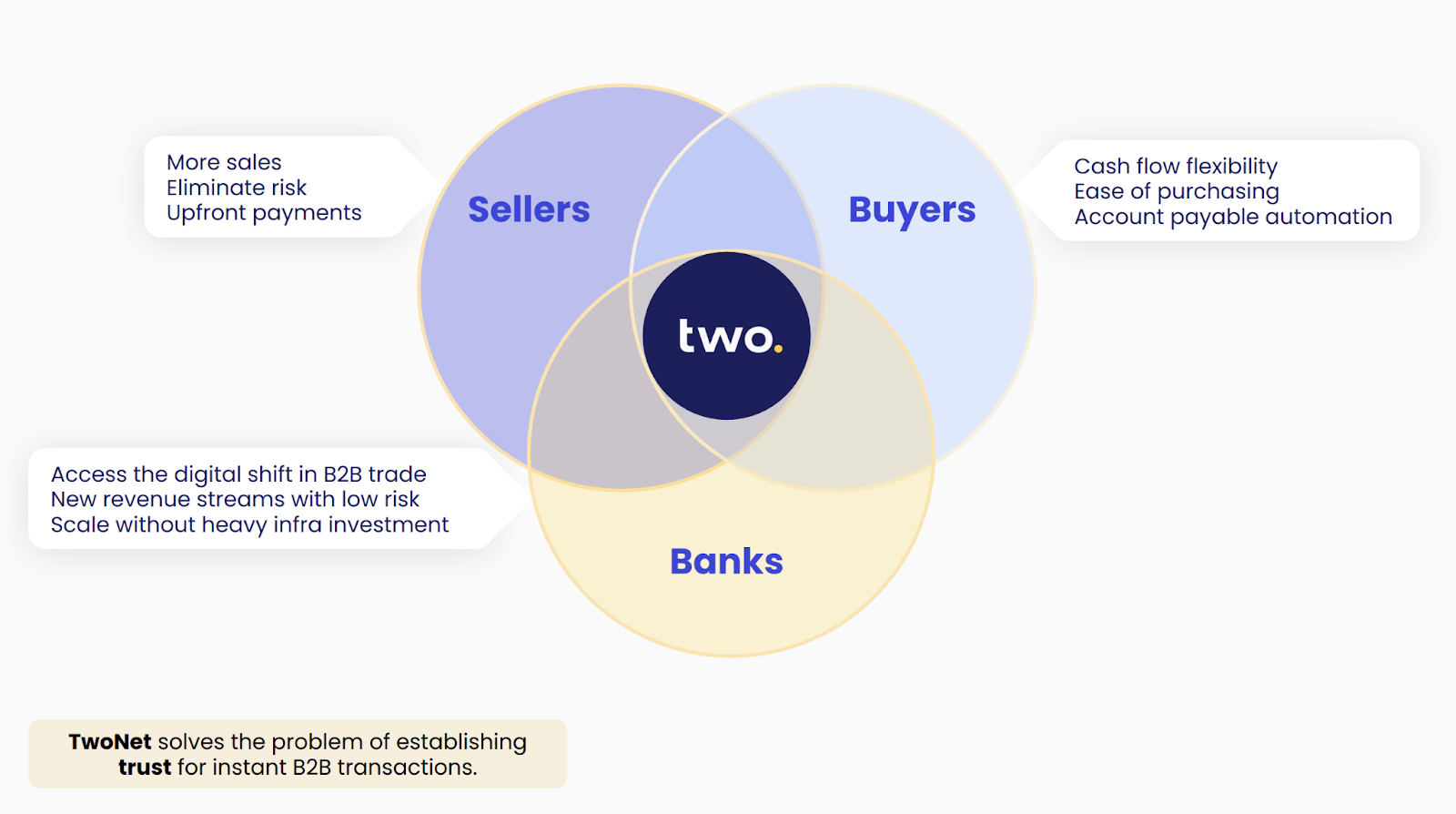

Capture the $200B Digital B2B Commerce Opportunity

Traditional trade finance can't meet the demands of online B2B commerce. Two's banking platform solves this challenge, enabling you to:

Establish trusted B2B transactions between businesses who haven't met

Apply your own risk policies and maintain control

Drastically reduce fraud through advanced verification technology

From Offline to Online Commerce

B2B commerce is digitizing fast, with $20T expected by 2027, driving demand for fast, trust-focused payment solutions

The Trust Gap in Digital Commerce

Unlike offline B2B, online transactions need instant trust between businesses that may never meet.

The Banking Platform for B2B Trade

B2B commerce is shifting online, requiring instant credit at checkout—traditional products like factoring can’t keep up.

Delphi Credit Engine

AI-powered credit assessment that outperforms traditional bureaus by 3.8x

Frida Fraud Engine

Advanced verification that reduces fraud by 99% compared to manual reviews

Bank Control Panel

Set credit parameters, risk thresholds, and monitor performance

Two Raises €13M to Build TwoNet - The Trust Infrastructure for B2B Commerce

Two flips this model...

Choose a Partnership Model

You maintain full control of credit decisions

Apply your existing credit policies

TwoNet provides the technology platform

Integrate with your core banking systems

Your bank retains the customer relationship

Typical fee structure: SaaS

Split credit risk based on your preferences

Set different thresholds by customer segment

Use TwoNet's AI engines with your overlay rules

Balance revenue and risk exposure

Performance-based pricing options

Typical fee structure: SaaS + revenue share per transaction

TwoNet manages the full credit lifecycle

Your bank earns fees per transaction

White-labeled under your bank branding

Fast deployment with minimal IT resources

Comprehensive fraud protection

Typical fee structure: Revenue share per transaction

Klar til å komme i gang?

Registrer deg for å prøve vår selgerportal eller bestill en demo med salgsteamet vårt.

Sell in-store

Boost efficiency

About Two

Bygget av kjøpmenn, for kjøpmenn.